Economic overview of Jordan in 77 years

ALBAWABA – Jordan’s National Independence Day is coming up, May 25, marking the 77th year since the Kingdom gained its independence in 1946.

Jordan in 77 years has seen significant changes, notwithstanding economic shifts.

These seven and a half decades saw the development of the public and private sectors, massive economic democratization, financial crises and recoveries, and more.

In 77 years, the country’s population grew from nearly half a million around 1950 to more than 11 million people, as of 2019. In fact, Jordan’s population more than doubled in the last 20 years, according to the World Bank.

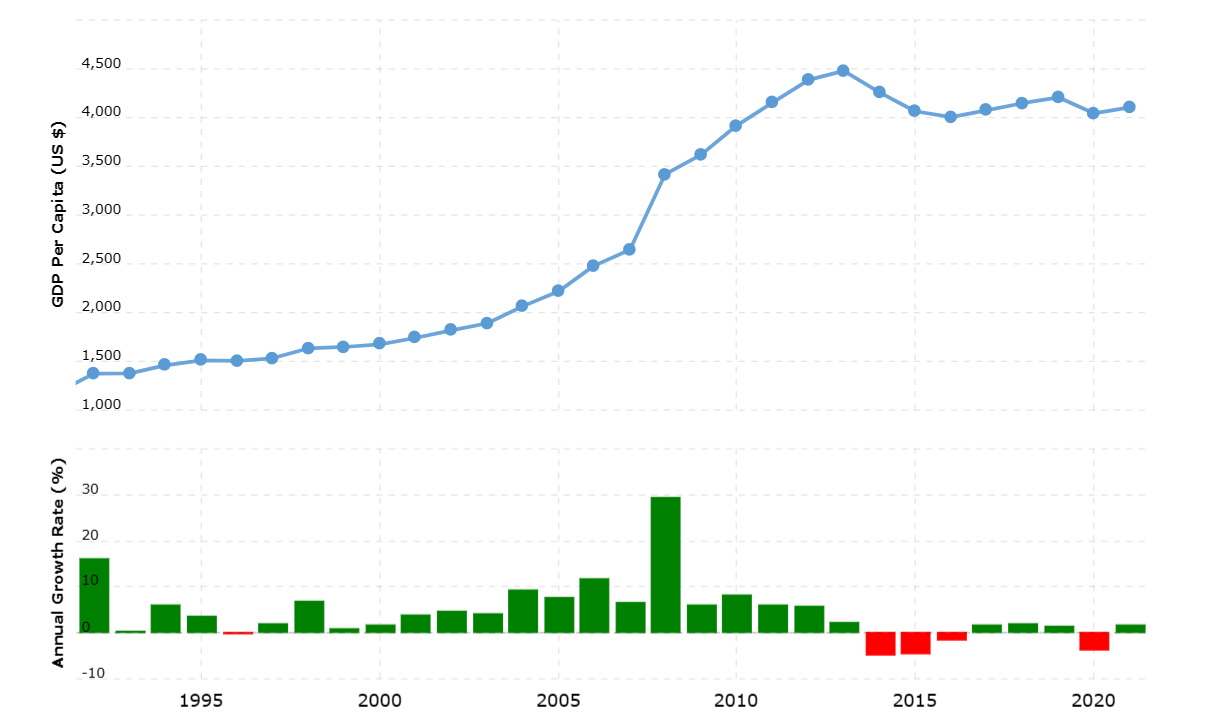

In 1965, Jordan’s Gross Domestic Product (GDP) stood at around JOD430 million ($600 million), data provided through economic monitor platform MicroTrends showed. Since then, the country’s GDP has grown by more than 750 percent, to JOD32.47 billion ($45.74 billion), as of 2021.

Today, Jordan stands as one of the most resilient countries in the Middle East, having endured and overcome so many economic challenges over the decades. Not to mention wars, refugee crises, civil conflicts, financial turmoil, and beyond.

Jordan’s Dinar, the country’s national currency, is the strongest in the region, second only to the Kuwaiti Dinar.

It is also one of the most stable currencies in the entire Middle East and North Africa (MENA) region. As it has retained its value against the United States (US) dollar since the early 1990s, through several global financial crises.

Economic turning points of Jordan in 77 years

Jordan’s economy has seen seven main turning points in the past 77 years.

Rise of the public sector

In 1921, the Emirate of Transjordan was established as a British protectorate, under the British Mandate of Jordan and Palestine.

At the time, Jordan’s economy was comprised mostly of micro vocational enterprises, shops in marketplaces, and conventional trade and commerce.

Up until the early 1930s, when an influx of wealth and trade began flowing into Jordan, mainly from Palestine and Syria, Jordan’s real economy depended mostly on these small-scale businesses. But slowly the public sector began to grow to comprise the backbone of the country’s economy.

Spike in foreign aid

In the aftermath of World War II (WWII), the West, namely the United Kingdom (UK) and the United States (US), entered a decades-long race with the Soviet Union to fill the political void in the Middle East region.

The US started the Four Point Program to facilitate support for friendly governments in the Middle East, Jordan included, following in the UK’s footsteps.

As US aid grew, Jordan’s public sector grew proportionately, until it became the main employer in Jordan and a catalyst of economic and local development, starting from the 1950s.

To put things into perspective, Jordan had 73 schools in the 1920s. Most of which was built by the government using foreign aid funds, both directly and indirectly.

By 2017, there were 2,787 government schools, 1,493 private schools, 48 community colleges and 19 universities, mostly financed by foreign aid, with the exception of private institutions.

Soon enough, the public education system would become one of the main employers in Jordan throughout the 1960s, 70s, and 80s.

From 1946 through 1983, Jordan received a total of JOD1.56 billion ($2.2 billion) in aid from the US alone, most of which was allocated to funding budget deficits, infrastructure and public services projects, and salaries.

A similar effort was launched by member states of the Gulf Cooperation Council (GCC) to support Jordan in the wake of the 'Arab Spring' of 2011. As of the end of 2022, Jordan had withdrawn JOD2.41 billion ($3.40 billion) out of JOD2.63 billion ($3.71 billion) pledged by a number of GCC member states in 2012.

Economic democratization

The race between the USSR and the West to win over allies in the MENA region accelerated what the World Bank and other international financial institutions called “economic democratization”.

Through economic democratization, electricity and water services were spread throughout most of Jordan, as well as other public services, such as healthcare and schools.

The race helped Jordan develop its welfare economy sectors and deliver its services to some of the most remote parts of the country. But this welfare economy did not make it into the 21st century.

Most of Jordan’s infrastructure was laid in the last 30 years of the Cold War.

In fact, Jordan was going to join the anti-communist Baghdad Pact in 1955, but the public took a stand against it and the state abandoned the pact.

A year later, a leftist government came to power, under Suleiman Nabulsi as Prime Minister, who later resigned in the wake of an attempted military coup by high-ranking army officers with alleged ties to Egypt’s pan-nationalist President Jamal Abdul Nasser.

These events signalled to Jordan’s Western allies that losing more countries in the region to the socialist and non-aligned blocs would have dire consequences for their interests. As well as for their historical ally, Israel.

Naturally, the prospect of a left-leaning Jordan did not sit well with the country’s Western allies, especially as Jordan’s role in the region gained momentum. Particularly since Egypt, Iraq and Syria began to distance themselves from the West in the 1950s.

Lucky for Jordan, having cultivated strong ties with the leading Western powers, the rise of leftist movements in Jordan in the 1950s through the 80s helped the state secure strong support from the US and UK. Most of which went to the development of the infrastructure and public services, in an effort to neutralise public discontent and dry out the well of dissent for communists, socialists, and leftists in general. So that they may not be able to leverage public dissatisfaction to fuel their causes, and it worked.

Today, about 99 percent of Jordan’s population is reported to have access to electricity, according to the Country Profile Report 2006 by the Federal Research Division of the Library of Congress. Whereas 98 percent of the population has access to an improved water source.

Sadly the fall of the Soviet Union in the early 1990s put an end to the race, and the world was left with only one economic bloc to sponsor economic development, the West, until recently.

In the midst of all this, the private sector was picking up pace.

Boom in the private sector

The Arab Bank is the first documented company registered in Jordan, established in 1930, according to publicly accessible data that AlBawaba was able to obtain.

Since then the private sector’s share in Jordan’s economy gradually grew to comprise nearly 85 percent of the country’s economy, as of June 2021.

Several waves of inbound refuge and immigration contributed to the layer-over-layer of private sector expansion in Jordan.

The inception of Israel in 1948; the war and carnage that came with it, and the 1967 war, drove many hundreds of thousands of Palestinians into Jordan. Having been under the British mandate for decades, many Jordanians and Palestinians spoke English and many others were seasoned vocational technicians.

The oil boom in the Arab Gulf region created demand for educated and skilled workers, favouring Jordanians and Palestinians, whose remittances to Jordan played an important role in fuelling the country’s economy through the 1960s, 70s, and 80s.

On the other hand, the 1990s saw a wide-scale privatization movement.

The liberalization of the economy during the course of the 1990s resulted in more job destruction than job creation, according to the International Labour Organization’s 2016 Employment Sector report.

Privatization of firms resulted in a large number of small private enterprises with limited employment-generation capacities.

In the meantime, the private sector was booming, and it was able to absorb a lot of the unemployed workforce back then.

Unfortunately, the lack of publicly accessible official data on the historical development of the private sector in Jordan prevented AlBawaba from obtaining the pertinent economic data.

However, today, the private sector employs nearly 2.2 million people in Jordan, as reported by Jordan News.

On average, the private sector has maintained its share in Jordan’s economy since 2010, ranging from 84 to 86 percent of the GDP, as per the US Bureau of Economic and Business Affairs.

Collapse of the Jordanian Dinar

In 1989, a huge corruption case was unveiled in Jordan, with the collapse of the Petra Bank.

The Central Bank of Jordan set up high liquidity ratios for Jordanian banks, at 30 percent, to curb the outflow of foreign exchange from Jordan and retain hard currency.

This required every Jordanian bank to deposit 30 percent of its reserves at the central bank.

By 1989, Petra Bank was the only Jordanian bank that did not comply. The bank was placed under the central bank’s supervision, subject to an audit. The founder of the bank fled Jordan, with a significant amount of foreign exchange missing.

The audit uncovered significant evidence of fraud and a JOD248.5 million ($350 million) bail-out was announced by the central bank to pay depositors, to avert a possible collapse of the entire banking system in Jordan.

The founder was charged and convicted in absentia by a Jordanian military tribunal. But the sudden outflow of foreign currency from the Petra Bank and the central bank’s bailout depleted the country’s reserves of foreign currency.

To prevent the full collapse of Jordan’s banking and financial system, the government was forced to accept an adjustment package presented by the International Monetary Fund (IMF).

The package would provide Jordan with the cash it needs to keep the financial economy up and running. but would require the devaluation of the dinar, by 50 percent, and the substantial rollback of government subsidies.

This IMF intervention is the first in Jordan’s history and marks the beginning of an entirely new financial era in Jordan. This era was characterized by heavy debts, wide-scale de-subsidization, and gradual dismantlement of large parts of the public sector and state-owned enterprises.

Surviving regional turmoil

Shortly after the collapse of the Petra Bank, the Iraq-Kuwait war broke out, and many Palestinians fled Kuwait to Jordan, bringing with them a wealth of corporate knowledge and investments.

The commercial sector in Jordan boomed in the early 1990s, and housing skyrocketed.

A little over a decade later, when the US invaded Iraq, many Iraqis sought refuge in Jordan, and demand for housing soared, whereas supply was limited. This increased housing prices dramatically.

The rising costs of housing and real estate in Jordan and the sudden influx of wealth sped up inflation. But it drove yet another wave of growth in the private and commercial sectors.

However, when the Syrian crisis started, and refugees began to flow into the country, Jordan’s infrastructure and public services began to suffer under the weight of more than one million Syrian refugees.

The Jordan Response Plan (JRP)’s budget for the years 2018-2020 was JOD5.192 billion ($7.312 billion), including JOD1.96 billion ($2.761 billion) for subsidies, security, income loss and infrastructure depreciation due to the Syria crisis. In addition to JOD1.5 billion ($2.126) billion for refugee-related interventions, and JOD1721 billion ($2.425 billion) for strengthening resilience. These include allocations for communities where both Jordanians and Syrians live.

As of January 2023, the JRP’s budget for 2022 was only fulfilled by 30 percent, according to The Jordan Times.

This means that Jordan was forced to shoulder the remaining 70 percent without the help of the international community.

Funding for the JRP has been declining over the past 10 years, and has fallen significantly from 51 percent in 2019, as reported by Relief Web.

Meanwhile, Syrians are afforded limited participation in Jordan’s economy, under strict legal provisions, in specific sectors, as reported by the West Asia-North Africa Institute in 2019. Notwithstanding, of course, the informal labour market.

Contrary to the case of Syrian refugees, the story of the Palestinian refugees’ role in Jordan’s economy is quite different.

According to the United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA), 2.2 million Palestinian refugees reside in Jordan.

Nearly 370,000 refugees were accommodated in ten internationally recognised camps.

However, for most Palestinian refugees registered with the UNRWA, the UN agency was responsible for most of their housing, healthcare, education, and a significant part of their employment efforts.

Moreover, most UNRWA refugees were granted full citizenship. So, they were relatively able to integrate with society and participate directly in the economy.

Not to mention the fact that many Palestinians relocated to Jordan as citizens from the get-go, while others were not registered with UNRWA, to begin with. Many of those too contributed directly to the growth of the private sector in Jordan.

As of 2009, a Human Rights Watch report estimated that more than 50 percent of Jordan’s population was of Palestinian descent. Almost all of them are integrated in Jordan’s economy.

This estimation includes refugees, Internally Displaced Persons (IDPs), and people who moved voluntarily from Palestine to Jordan before and after the inception of the occupation state of Israel in 1948.

Reforms, privatization and PPPs

Since the collapse of Petra Bank, in 1989, the IMF has played a vital role in Jordan’s financial economy and policies. As well as in the provision of aid and support, in the form of soft loans, grants, and other kinds of financial and technical support.

Over the years, Jordan’s dependency on aid grew, to the point that the government was unable to invest in capital projects that would generate income. Whereas most of its budget was allocated to current expenses and salaries. A significant amount of which was financed by aid.

Current expenses comprised 75.1 percent of the government’s expenditure under the budget of the year 1990, as per the report on Jordan Economic Development in the 1990s and World Bank Assistance, published in 2004.

Many of the government’s State-Owned Enterprises (SOEs) were sinkholes of public funds, despite being significant sources of public income.

In the 1990s, Jordan realized that in order to meet the criteria of the World Bank (WB) and IMF for new credit facilitation programs, the state would have to let go of some of its public sector assets.

With the support of international financial institutions, the government sold its shares in Jordan’s potash and phosphate manufacturing companies, among other assets.

To date, the government holds minority shares in some of these enterprises and has only retained its shares in the Jordan Petroleum Refinery Company and the National Electric Power Company. Alongside a number of other smaller enterprises.

Currently, 17 SOEs of different sizes and mandates are fully owned by the government of Jordan, according to the US Bureau of Economic and Business Affairs.

Five of these SOEs were established in 2016 and are not yet operational, as of 2019. Whereas the assets of wholly-owned SOEs exceeded JOD7.8 billion ($11 billion) in 2018. They employ around 3,000 individuals.

After the sale of Jordan’s main industrial SOEs, which started in the 1990s and peaked later on in the 2000s, the government shifted to what is known as Public-Private Partnerships (PPPs).

PPPs are a mechanism for governments to procure and implement public infrastructure and services using the resources and expertise of the private sector.

In most implementations of this model in Jordan, no privatization takes place, such as in the case of the Queen Alia International Airport.

Jordan has attracted more than JOD6.39 billion ($9 billion) in PPP investments since 2004, in addition to recently signed projects, at a combined value in excess of JOD 5.68 billion ($8 billion), since December 2022.

Another major reform entailed several adjustments to the income tax laws in Jordan.

The IMF launched the Extended Fund Facility with Jordan in 2016, contingent upon the implementation of structural reforms.

The program, with the government, aimed at lowering public debt to about 77 percent of GDP by 2021, while providing room for capital spending and preserving social spending. Key measures include revenue-enhancing reforms to the tax system, such as reforming the tax exemptions framework and broadening the tax base, according an IMF press release in 2016.

This meant expanding the taxable population, structurally, to generate more tax revenue for the government.

Jordan’s tax revenue was reported at JOD4.68 billion ($6.598 billion) in December 2018. Up from JOD4.47 billion ($6.307 billion) in 2017, as reported by CEIC.

Overall, the government’s revenue from taxation increased by roughly JOD210 million ($295.98 million) in the two years since the structural reforms were implemented.

Revenue from income and sales tax in 2022 totalled JOD5.76 billion ($8.12 billion), as reported by The Jordan Times.

Still, the country’s national debt has been consistently rising since 2018.

According to Statista’s data, Jordan’s national debt increased from JOD22.90 billion ($32.27 billion) in 2018 to an estimated JOD30.98 ($43.67 billion) in 2022.

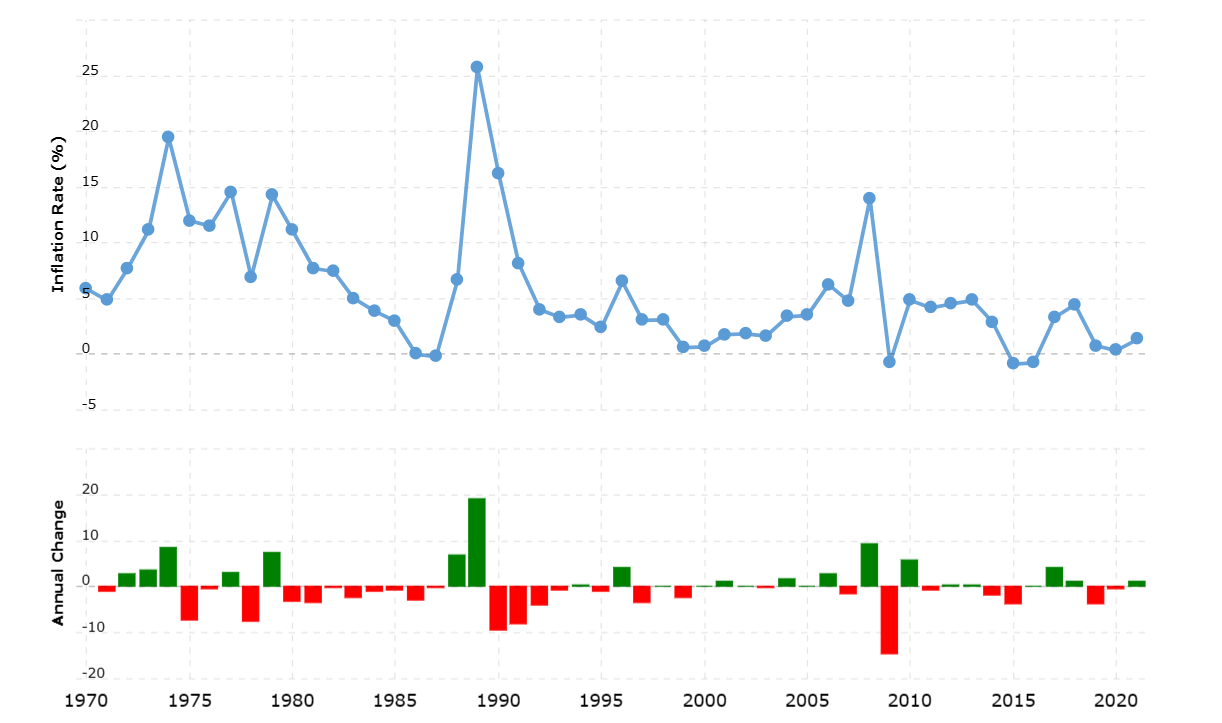

Managing inflation

Once again, inflation first began to soar almost exponentially with the collapse of Petra Bank. The value of the Jordanian dinar halved back then. But the central bank was generally able to retain its current value for more than 30 years today.

Overall, the Jordanian Dinar has lost no more than 0.86 percent of its value against the US dollar, since 2003, according to Google Finance.

Thanks to effective monetary policies enacted by the central bank, and most notably its former Governor Ziad Fariz, from 2012 through 2022, the dinar was able to stay stable.

Nonetheless, inflation remains an issue in Jordan and the entire region.

The inflation rate for consumer prices in Jordan moved over the past 52 years between -0.9 and 25.7 percent, according to World Data.info.

During the observation period from 1970 to 2022, the annual inflation rate averaged 5.8 percent. But overall, the price increase was 1,636.98 percent.

The global inflation median ranged from 1.5 to 4.7 percent in the 1960s, up to 14.4 percent in the 1970s, averaging around 14 percent in 1980.

Regionally, the MENA region’s inflation average ranged from 3.7 percent in 1970 and 4.9 percent in 2022, peaking at 14.2 and 11.3 percent in 1974 and 2008, respectively. The lowest regional inflation recorded was 0.7 percent, in 2020.

High-interest rates prevented dollarization through the most difficult times, especially in the aftermath of the 2008 financial crisis, when the ripples of the crisis finally got to Jordan in the early 2010s. High rates also helped control inflation over the past 10 years.

The rise in US interest rates has recently driven Jordan's own rates sky-high. Interest on individual and personal borrowing exceeded 10.5 percent for retail loans in some banks in Jordan, as of 2023.

Since 1995, the Jordanian Dinar has been pegged to the US dollar, which leaves the dinar vulnerable to further rate hikes by the US Federal Reserve Board, in the coming months.

Jordan in 77 years: Where do we stand?

In March 2023, the government approved the Executive Program for Economic Modernisation (2023-2025), the strategic objectives of which are to raise annual income per capita by 3 percent and create new jobs.

This program is a framework for the execution of the Economic Modernisation Vision, which outlines several PPP projects at the estimated value of JOD 10 billion ($14.08 billion) in various sectors, such as water desalination, schools, clean energy, transportation, and infrastructure, within 10 years.

Since December 2022, the government brought in more than JOD 5.68 billion (USD 8 billion) worth of investments and PPP projects.

So far, the government was able to achieve 21 percent of the 10-year new economic vision targets.

Eventually, the government's aim for economic modernization ultimately hinges on its capacity to resolve as many of the sector's issues as soon as possible, while keeping the current pace. If it succeeds in doing so, the PPP market in Jordan may attract more and more domestic and international investors in the years to come.